Publish Date: July 28th, 2025

With the passing of the reconciliation bill, it’s no doubt that the solar industry will change. With 20 years under our belt, Namaste Solar knows that evolution isn’t something new to solar. We caught up with Jason Sharpe, Jon Wedel and Matt Johnson, who combined have over 60 years in the solar industry, to chat about what this next chapter on the solar coaster could look like.

The reconciliation bill has passed. How do you think this could affect the solar industry?

Jason Sharpe: With the Inflation Reduction Act (IRA) we had the longest understanding in our 20-year history of what our future market would look like – it was a 10 year plus outlook. The reconciliation bill ends that in a very abrupt manner, no one in the industry was expecting such a change so fast. And so, it’s like being on the runway and the engines getting turned off. Billions of dollars in manufacturing, billions of dollars in project deployment was all being launched over the last three years. And now that is being interrupted in a significant way.

I think it’s difficult to understand the future market right now. I think different market segments will be impacted in different ways.

Matt Johnson: I do think we’ll see a downturn in the residential market, how big is something we’re still trying to determine. There will be an increase in electricity rates to consumers, and that will help to continue to foster the market as the homeowner will still be able to see a good value proposition and a reason to go solar. So, we believe that there will be a market for residential solar. We’re still determining the exact size and makeup. We also feel like Colorado is a good market to have residential solar. Lots of sun, lots of environmentally minded people, and we’ve got a great brand with name recognition in the market. It’s just going to take a little time but there will be a robust residential market in the future.

Jon Wedel: What I would add is for over two decades renewable energy really hasn’t been so heavily politicized. The country has energy goals, and we were a part of that. This market has thrived because we’ve been in alignment with the federal government, state government, and local government’s push to deploy energy to the grid, which is an obvious need with AI and data centers. So, I think what’s different with this bill is not so much the changes in incentive structure; what’s different is the language outside the bill. It’s the, “We want to kill this.” It’s directing the Department of Interior to put up roadblocks. And so, it’s not just that there is less runway or less incentive, it’s that we’ve got a federal government now aligned against this type of energy technology, and we’re going to have to succeed despite that opposition.

How confident are you feeling in Namaste Solar’s future?

Jason Sharpe: Very. In a word. Being an employee-owned, big-small company, and being well capitalized is good for us. We’re diversified in revenue. We’re established. We’ve been here 20 years. We’ve weathered these storms in the past.

Jon Wedel: I think we do business differently. We’re a worker owned cooperative, we’re a benefit corporation, we’re a Certified B Corp, and we’re not trying to drive profit to a single person or a single group. And I think if that were the case, this would be a more difficult time and you’d be looking at things strictly through a financial lens asking, “Is there still enough profit left in this thing?” And that’s not what we’re here for. We’re here to continue transforming energy and transforming business. We’re here to deploy solar and we plan on doing that for another two decades and beyond.

How could this help the industry evolve?

Matt Johnson: Personally, I’m excited to sell in a non-federal tax credit environment. I think it allows, from an operational perspective, for much smoother operations. We won’t have an end of year rush every year for folks wanting to qualify for the tax credit.

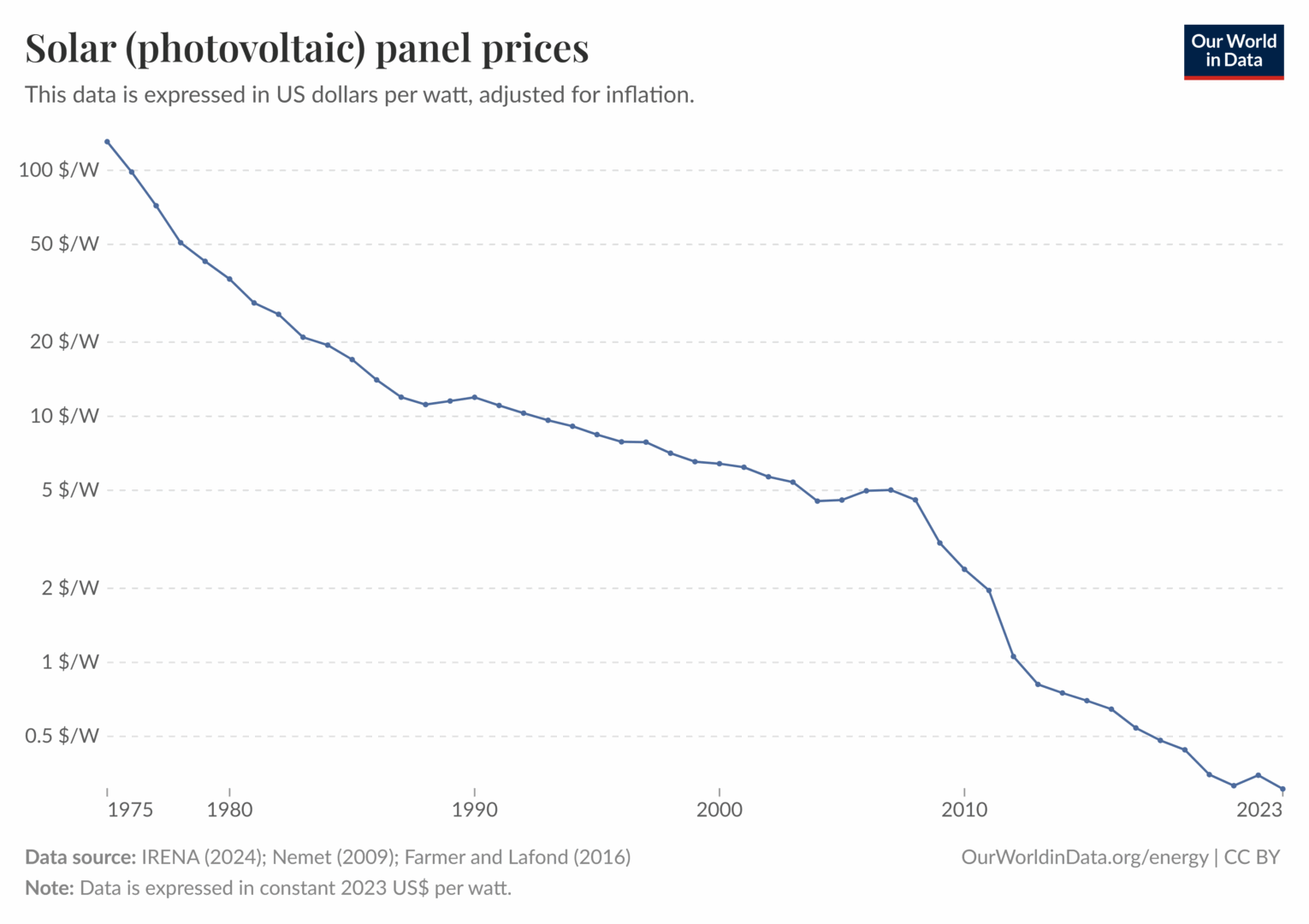

Jason Sharpe: I think the next challenge as an industry is storage. Storage is the long-term solution and needs to be the future of the market. So, how do we move to cost-effective storage deployment? The cost of solar is reduced to the point where we likely can survive without federal support, but this next energy transition to advanced technology and storage deployment is where the cost effectiveness might need help and subsidies are great to create a market and to get to economies of scale.

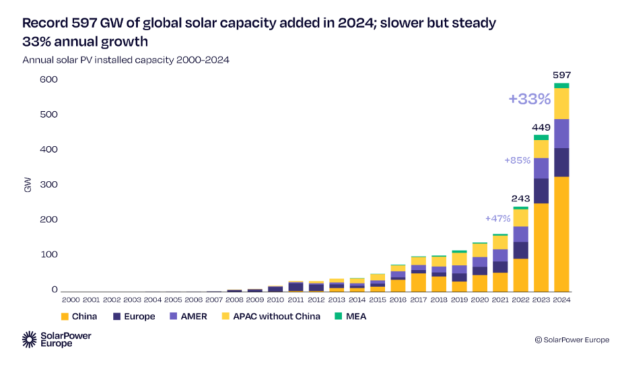

And what the IRA did, and what is not happening now, was create incentives for domestic manufacturing, which is a stated goal of this administration and prior administrations. I think that’ll be the next challenge as a nation is how to keep up with American manufacturing, how to keep up with China, and how to be a part of the renewable energy future of the world. China deployed more solar projects in 2024 than the rest of the world combined. It’s unfortunate that this administration is prioritizing old technology and entrenched power and entrenched interests in the fossil fuel industry as opposed to being a global leader in the future of energy in the world. I see this as a step in the wrong direction for American energy and for American leadership.

Jon Wedel: I’m just super disappointed. To provide some context for anyone who might not know why storage is important, the knock-on wind or solar is it’s not 24/7. And so how do you harness the power of these technologies and deploy the energy at the right time or during the times when the sun’s not shining? That’s why storage is so critical.

Jason Sharpe: Where are subsidies appropriate and when do they work? If you look at the cost curve of the cost of solar panels over the last 50 years, I think that’s a success story. The current version of the ITC was initiated by Bush and it’s been extended in a bipartisan fashion for the last 20 years. Before the IRA, the last time the tax credit was extended was during Trump’s first term. So, this has not always been a political issue. Rather, it’s been an American energy priority until this current administration has decided it’s a political issue, and that’s unfortunate.

Jon Wedel: This thing has become politicized and even down to the words subsidy or tax credit. Take your pick which one sounds better. They’re both trying to free up the American economy to get things done on behalf of our country and accomplish our goals. So again, it’s just super disappointing that we find ourselves so politicized and in the crosshairs as an industry when you know our primary goal is to put more energy on the grid. It’s a known issue that we need more energy.

And of course, the fossil fuel industry has been subsidized much longer than solar.

Jason Sharpe: Centuries. And if you added together the value of subsidies the fossil fuel industry has received, it vastly outnumbers what renewable energy has received in the last 20 to 30 years. But solar energy’s vilified because a consumer gets a benefit. This repeal eliminated every energy related consumer tax credit available; electric cars, home energy efficiency, heat pumps, electrification, and renewable energy. Why can’t we give tax credits to consumers? Apparently you can’t trust homeowners, doing that is a scam.

We’ve talked a bit about how energy is political. Can you speak to this more? Is there a hope that this won’t always be the case?

Matt Johnson: To me, that’s the dream of solar energy. There’s so much energy coming from the sun onto the earth. Why do we have energy struggles? There’s more energy than we need. It doesn’t need to be politicized. There’s enough energy for everyone if we deploy it, and that’s the utopia idea not having to be under the thumb of a utility company or paying fossil fuel companies. You can take control of your own energy needs.

Solar has hit a critical mass. Can you explain that for folks?

Jason Sharpe: The solar industry is not a U.S. only industry. It’s a very large and well-established global industry generating hundreds of billions of dollars in revenue annually. I don’t know how to express how big hundreds of billions are, but it’s a really big number.

Jon Wedel: According to the New Yorker, it took from the invention of the photovoltaic solar cell in 1954 till 2022 for the world to install one terawatt of solar power. That’s a trillion watts. The second terawatt came just two years later and the third is going to arrive later this year or early next. So, all of a sudden, you’ve got 3 terawatts, but two have come since 2022. That’s how we know critical mass is happening.

What do you think the public needs to know about the end of the solar tax credit?

Jon Wedel: For commercial, if you own a commercial business and you’re interested in solar, give us a call ASAP. We can still secure the tax credit for you. There’s a runway on the commercial side. We can still get you safe harbored in the next 11 months. The second half of this year is the most critical before potentially other rules and regulations kick in starting in 2026.

Jason Sharpe: I’d say along those same lines, the end of the ITC does not mean the end of the solar industry and does not mean the end of residential solar. So, this is not the end, it’s just a new chapter. We’re working on financing options and lower cost solutions to continue to return a great value proposition for homeowners.